Risk Management Solutions for Insurance

Based on massive data and perfect risk management models in combination with 3rd-party authentication data, and with the concept of cross-platform joint defense, we provide insurance clients with fraud risk prevention in multiple scenarios, enhancing the overall risk management capability of insurance business and reducing potential fund losses.

Common Application Scenario

Credit Insurance Scenario

- Fake Application

- Intermediary Application

- Bull Borrowing

- Credit Deterioration

- Missing Overdue Information

Internet Insurance Scenario

- Credit Speculation

- Garbage Registration

- Data Crawling

- Card Theft & Embezzlement

- SMS Bombing

- Spams

Health Insurance Scenario

- Malicious Concealment

- Excessive Insurance

- Reverse Option

- Intermediate Agency Fraud

Integrate data from thousands of financial enterprises to eliminate data silos,thus helping you see all borrowing users clearly in an all-round manner.

Scenario is customized for risk control schemes and the user’s experience toward online insurance gets another upgrading.

Verification of user’s information is conducted in a trans-platform way and risky users are identified in a multi-dimensional way.

Perform full life-cycle monitoring for each user applying for loan, enhance the platform's risk management capacity in the links such as prevention of fake pre-loan applications, monitoring bad credit history, post-loan credit changes and cumulative increase of liabilities, thus adding more risk management dimensions and reducing the risk of fund losses for the platform.

Risk scenarios area avoided, including click farm, credit speculation, garbage registration and card theft payment. A sound online insurance environment is formed to help the sound development of the platform.

The platform is assisted in identifying risky users from multi-dimensional perspectives and the potential risks of capital loss are decreased.

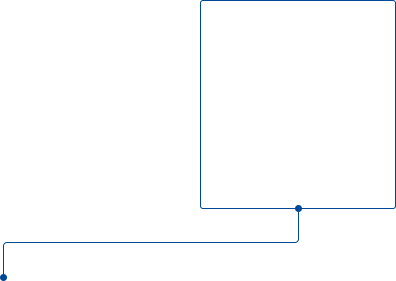

Loan UnderwritingPost-loan MonitoringPayment FraudJoint ModelingTongdun Zhixin ScorePromo Abuse DetectionInterface Abuse DetectionPayment FraudAccount Takeover/Abuse DetectionAnti SMS Interface AbuseContent Abuse DetectionLoan UnderwritingPost-loan MonitoringTongdun Zhixin ScoreJoint ModelingBusiness Process Risk Management Deployment

- Credit insurance business

- Internet Insurance Scenario

- Health Insurance Scenario

If you have higher requirements on post-loan monitoring, the following services are recommended:

Loan UngerwritingPost-loan MonitoringTongdun Zhixin ScoringClient cases

- +65 68095044Hotline